How can XM Rebates Contribute to Trading Cost Reduction?

In the world of Forex trading, profitability doesn’t just depend on winning trades—it also relies heavily on how well traders manage their costs. Even small reductions in spreads and commissions can make a big difference in long-term results. One of the most effective ways to lower these expenses is through XM rebates, often known as XM Cashback or Forex Cashback.

This article explains how XM’s rebate system works, why it matters, and how it can significantly contribute to overall trading cost reduction.

Understanding XM Rebates

XM rebates are a form of cashback offered to traders based on the trading volume they generate. Every time a trader opens or closes a position, XM collects a small fee (spread or commission). The rebate system returns a portion of that cost back to the trader, effectively reducing the total trading expense.

In simpler terms, it’s a reward for trading activity. Whether you trade frequently or occasionally, you can earn a percentage of your costs back—directly as cash, credit, or balance in your trading account.

This makes XM Cashback an important cost-management tool, especially for high-volume or long-term traders.

How XM Cashback Works in Practice?

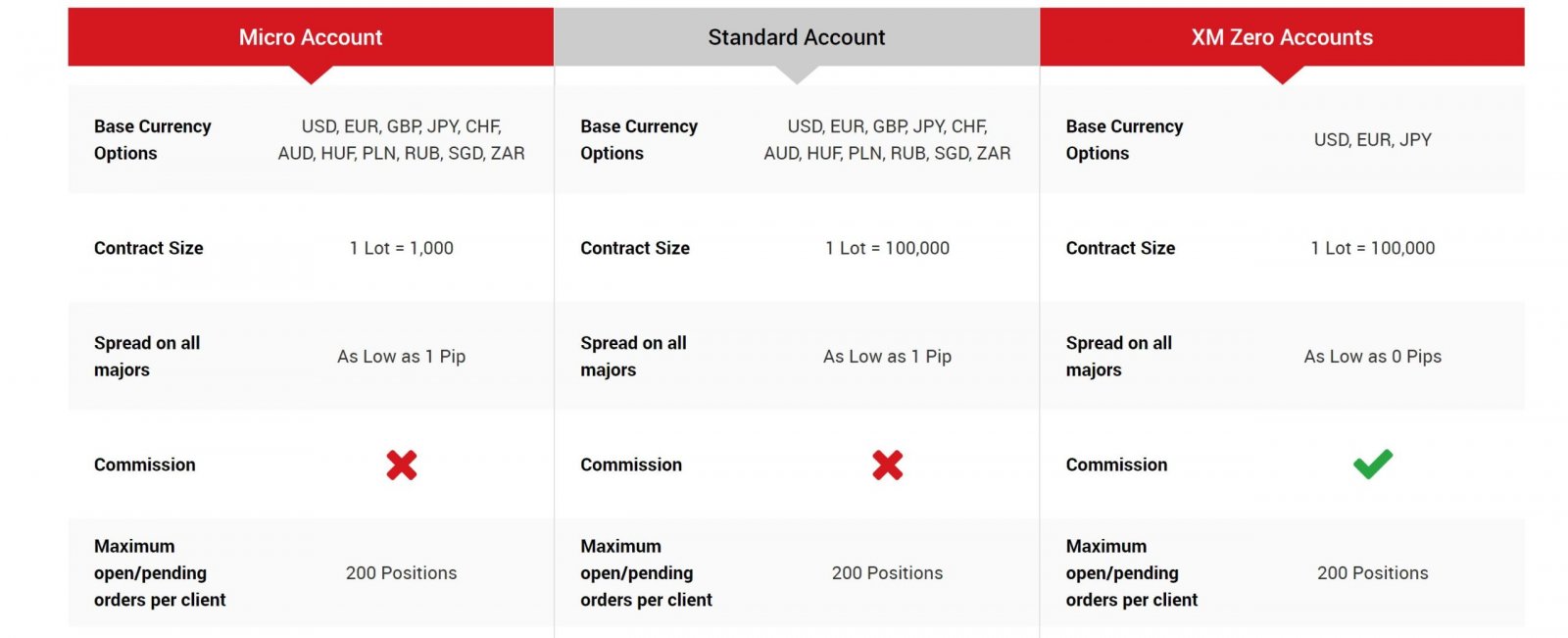

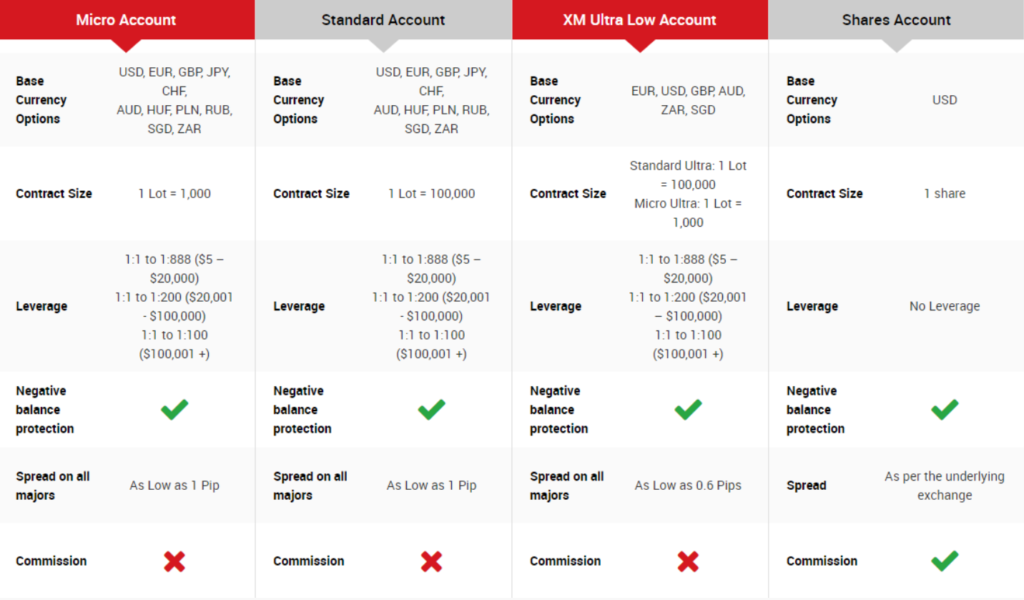

XM operates with multiple account types—Standard, Micro, and XM Zero—each with different spread structures. Rebates are calculated per lot traded and can be credited daily, weekly, or monthly depending on the arrangement.

Here’s a simplified example:

-

Suppose you trade one standard lot on EUR/USD.

-

XM charges a small spread or commission per trade.

-

Through a Forex Cashback arrangement, a portion of that cost (say $5–$7 per lot) is returned to your account as cash.

Over hundreds of trades, this rebate adds up directly improving your net trading performance without requiring any changes to your strategy.

The Role of XM Rebates in Cost Reduction

Trading costs come mainly from spreads, commissions, and swaps. XM rebates help reduce these costs in several ways:

-

Lower Effective Spreads: When you receive a rebate, the effective cost per trade becomes smaller. For example, if the spread on EUR/USD is 1 pip and you receive a rebate equivalent to 0.3 pips, your effective spread is now just 0.7 pips.

-

Improved Profit Margins: Every rebate directly increases your bottom line. The less you spend on trading costs, the more you retain from your winning trades.

-

Increased Volume Potential: Reduced costs encourage traders to scale their strategies more confidently. High-frequency traders, scalpers, and algorithmic traders benefit most from consistent XM Cashback.

-

Smoother Equity Growth: Regular Cashback credits act like mini income boosts, helping traders sustain longer-term consistency, even during market drawdowns.

In essence, XM rebates transform every trade into an opportunity to save money and earn more efficiently.

XM Cashback vs. Traditional Discounts

While some brokers offer temporary fee discounts, XM Cashback provides a continuous and measurable benefit. Discounts usually depend on trading tiers or promotional periods, but Cashback is performance-based and lasts as long as you trade.

Moreover, Cashback is transparent and trackable. XM’s Partner Portal and client dashboard clearly display rebate calculations, so you always know how much you’re earning and saving.

How Traders Can Maximize XM Rebates?

To make the most out of Forex Cashback with XM, consider these proven strategies:

-

Choose the Right Account Type: XM’s Zero Account offers the lowest spreads, while Standard and Micro accounts may include higher rebates. Select the option that aligns best with your trading style.

-

Trade consistently and strategically: The more you trade, the more rebates you earn. However, focus on high-quality setups rather than overtrading just to generate Cashback.

-

Partner with a Rebate Provider: Some affiliates offer enhanced XM Cashback rates or additional bonuses. Collaborating with a trusted partner can maximize your total returns.

-

Monitor and Optimize Performance: Track your rebate earnings alongside your trading results. Evaluate how much cost reduction you’re achieving and adjust your volume or strategy if needed.

Why XM Rebates Stand Out in the Forex Industry?

XM has built a reputation for honest rebate distribution and transparent trading conditions. Unlike some brokers that complicate withdrawal procedures or impose hidden fees, XM provides direct Cashback payments—often instantly after trade settlement.

Combined with its global regulation (CySEC, ASIC, FSC) and user-friendly platforms, XM ensures that both new and experienced traders benefit from fair cost structures.

This reliability strengthens XM’s standing as one of the top choices for traders looking to combine performance, transparency, and value.

Final Thoughts

So, how can XM rebates contribute to trading cost reduction? The answer lies in their consistent, measurable impact on your bottom line. By earning XM Cashback on every trade, you effectively reduce spreads and commissions, improve your profit margins, and gain better long-term sustainability.

Author: Asim Rahman

Remplacez les images

Remplacez les images

Remplacez les textes

Remplacez les textes

Personnalisez !

Personnalisez !